Majority of marketers and agency professionals see events as more useful than individual meetings and attend for key intelligence and networking – but they want more focus on audience issues.

NEW YORK (September 29, 2017) – More high-level advertisers are coming to the Upfront and Digital NewFront events for networking and intelligence, and they want more stage time devoted to audience effectiveness and measurement. That’s the key finding of the 2017 Upfront/NewFront Report from Advertiser Perceptions, which analyzes the motivations and reactions of advertisers attending the May and June events.

“No other marketing opportunity has the power to drive perceptions of media brands like the Upfront/NewFront events, ” said Randy Cohen, president of Advertiser Perceptions. “Advertisers are coming with broader agendas and expectations now. They’re looking for intelligence from media companies and peers on how to best navigate a more complex audience landscape.”

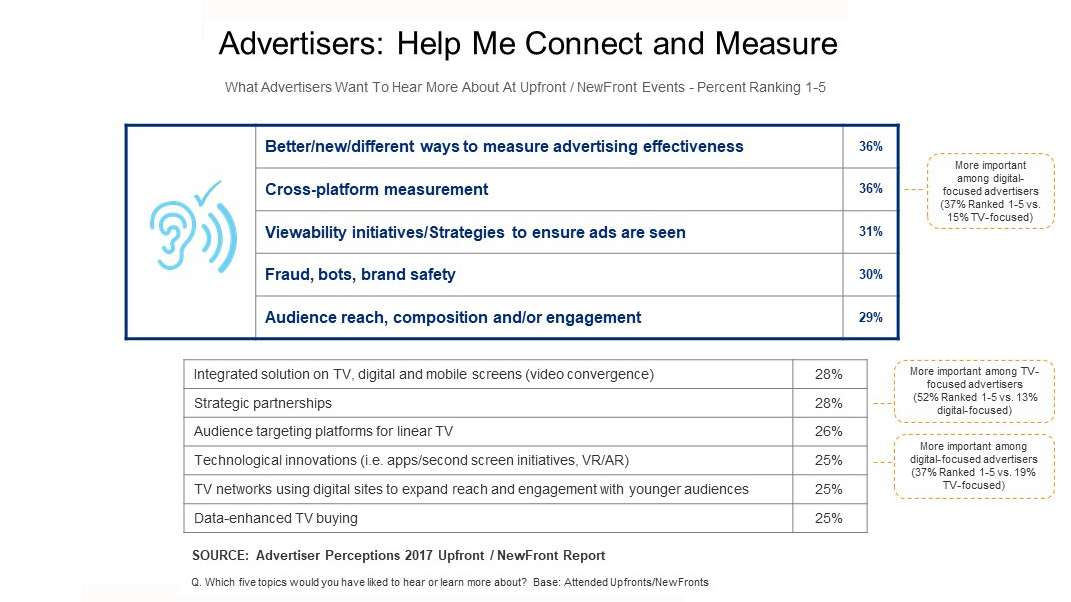

Advertisers came looking for ways to reach networks’ and platforms’ audiences more effectively; and the quality of research determined their ratings of presentations more than any other factor. In their eyes, networks and platforms most emphasized their content, audiences and ways to measure advertising effectiveness. But they wanted more on a range of issues led by brand safety, cross-platform measurement, strategic partnerships and viewability. Among digital advertisers, cross-platform measurement topped the list, whereas strategic partnerships were the most cited by TV-focused advertisers.

On average, advertisers attended 12 events in person or via simulcast. Fully 85% said the events helped them make ad spending decisions. Although several major platforms pulled out of this year’s NewFronts, 87% of advertisers see value in these events; but 25% of those believe digital brands need to bring more compelling content to the stage.

Some 73% cited the events – whether attending in person or online – as their preferred way to learn about new programming opportunities, while 68% said the quality of talent influenced their perception and investment with media presenters. Asked for the top ancillary benefit to in-person attendance, 29% cited relationship building with media, clients and agencies; 25% said strategy sessions; and 19% said the explanation of tech media extensions.

“More than anything, advertisers want to know how to prove and leverage the audience connection that new programming will create,” said Andy Sippel, senior vice president of media consulting at Advertiser Perceptions. “Tackling critical industry issues head on is an essential part of the conversation.”

Advertiser Perceptions interviewed 373 advertisers (54% agency, 46% marketer) during May and June 2017. Subjects represented a cross-section of the advertiser population, including 16 industry categories and 33 of the top 200 advertisers. Fully 49% of subjects hold positions at VP level or above.