Advertiser Perceptions finds spending increasing and expanding across media types.

More than half of advertisers have increased their spending on digital retail ads during the pandemic, and most of the rest expect to bounce back in the second half of the year. That’s the upshot of new research from Advertiser Perceptions, which points to a boom in retail advertising as advertisers spread retail ads out to more forms of media.

“Online retail has taken center stage over the past year as more people stay, work and shop from home,” said Stuart Schneiderman, SVP/Business Intelligence at Advertiser Perceptions. “Advertisers are following suit fast, and they’re widening their media mixes to do it. The Internet is becoming the priority marketplace, and click to buy a reflex, for an increasing percentage of American consumers.”

All signs up. Specifically, 55% of advertisers have increased their retail ad spending, 18% of them significantly, in the past year. Meanwhile, 20% have maintained levels and 26% have decreased spending, with most of those trimming minor amounts. Of those that decreased advertising, 11% are restoring spending levels in the second quarter, while 44% will return in Q3 and 24% in Q4.

More retail media. Retail-specific media are benefitting from the action. Overall, 65% of advertisers are using retail media, and 71% of the outliers are considering adding retail media to their plans. Specifically, usage and consideration are highest for ecommerce sites – maintaining the momentum Advertiser Perceptions defined in an initial wave last fall – while more advertisers are using and considering retail media networks and retailer websites than last fall.

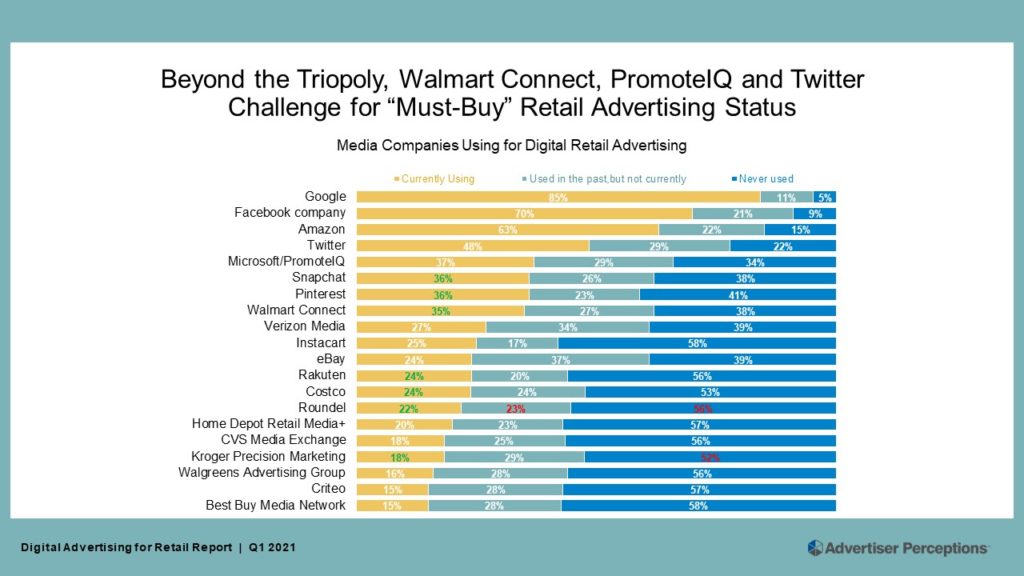

Beyond the triopoly. Demand is broadening the business beyond the triopoly (Google, Facebook, Amazon). Walmart Connect, PromoteIQ, and Snapchat now register as “must buy” media for a significant percentage of advertisers.

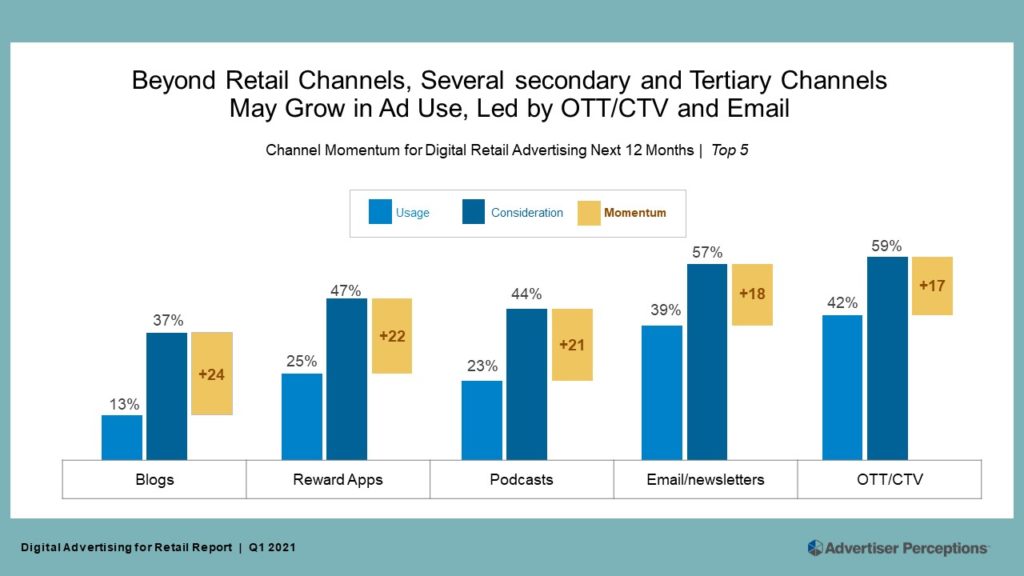

What’s more, advertisers are putting more retail ads in secondary and tertiary channels, led by OTT/CTV. There’s considerable momentum also for podcasts, email newsletters, reward apps and blogs.

“Advertisers are broadening their thinking on retail beyond simple transactional promotion,” said Schneiderman. “They’re putting a full array of brand and performance ads across the wider universe of media channels.”

Three trouble spots. The main challenges for advertisers are data security, cost and targeting. Data security worries 48% of advertisers, while 42% aren’t satisfied with targeting capability and 38% take issue with the cost.

“Retail advertisers are principally frustrated with not being able to tell where their customers and prospects are on their decision journeys, so they can serve relevant messages,” said Schneiderman. “Restrictions on cookies and personal IDs simply intensify the gaps. The main thing retail advertisers tell us they want from media partners is more accurate, timely consumer understanding and connection.”

Advertiser Perceptions interviewed 250 advertisers (40% marketer, 60% agency) principally involved in retail advertising from its proprietary Ad Pros community in February. A similar panel was interviewed for the initial wave in May 2020.