Advertiser Perceptions finds most retail advertisers are running more digital and in-store ads, while nearly 70% already use or are testing live stream shopping.

The holiday season will see a rebound in digital ad spending this year, as 47% of digital retail advertisers are significantly increasing their holiday spending online compared with 2020, according to the new Digital Advertising for Retail Report from Advertiser Perceptions. One-third of advertisers started their holiday promotions earlier this year to match earlier consumer shopping patterns, and three in 10 are boosting in-store ad spend as well.

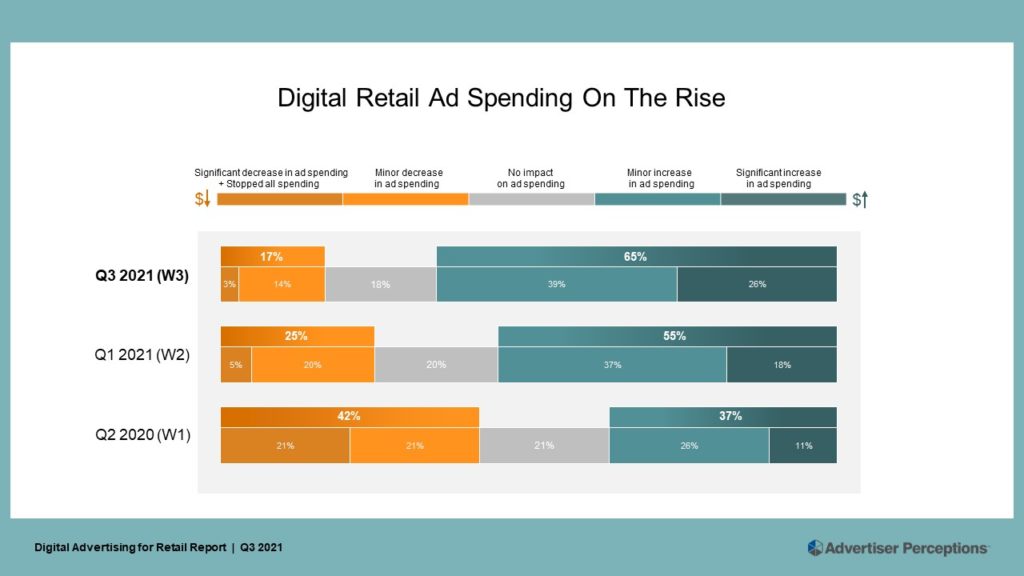

Pandemic continues to boost digital retail advertising. Although pandemic variants and supply chain issues have tamped down consumer confidence, the digital retail ad market continues to grow meaningfully. When we asked in Q3 how COVID-19 had affected their digital retail ad spending levels, two-thirds of advertisers reported having increased budgets, up from 55% who said the same in Q1.

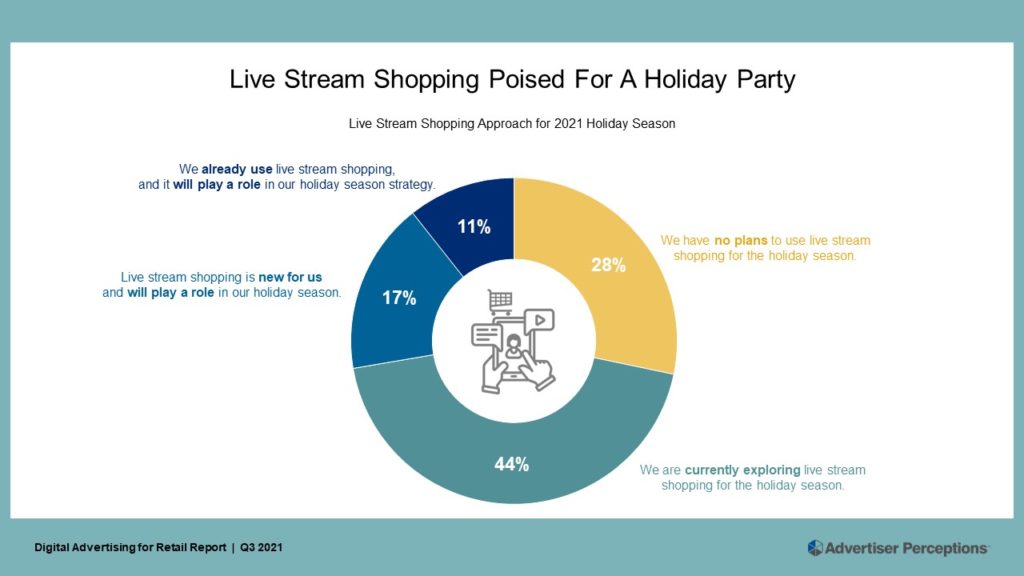

Live streaming blossoms. One of the beneficiaries of growing investments is live stream shopping, which is emerging as a critical way to connect with brand-buying audiences. Last year, 11% of advertisers included live stream shopping in their holiday campaigns, and another 17% are giving it a role this year. An additional 44% are considering using the medium this holiday season.

“A year from now, a lot of brands are going to look back at this holiday season and say, ‘that’s when live stream shopping really started for us,” said Stuart Schneiderman, SVP/Business Intelligence at Advertiser Perceptions. “Advertisers know they need to meet consumers where they are and gain control over a greater variety of brand messages. Live stream shopping has the potential to create instant product impact on a scale physical retail can’t generate. The Internet doesn’t have a maximum capacity limit.”

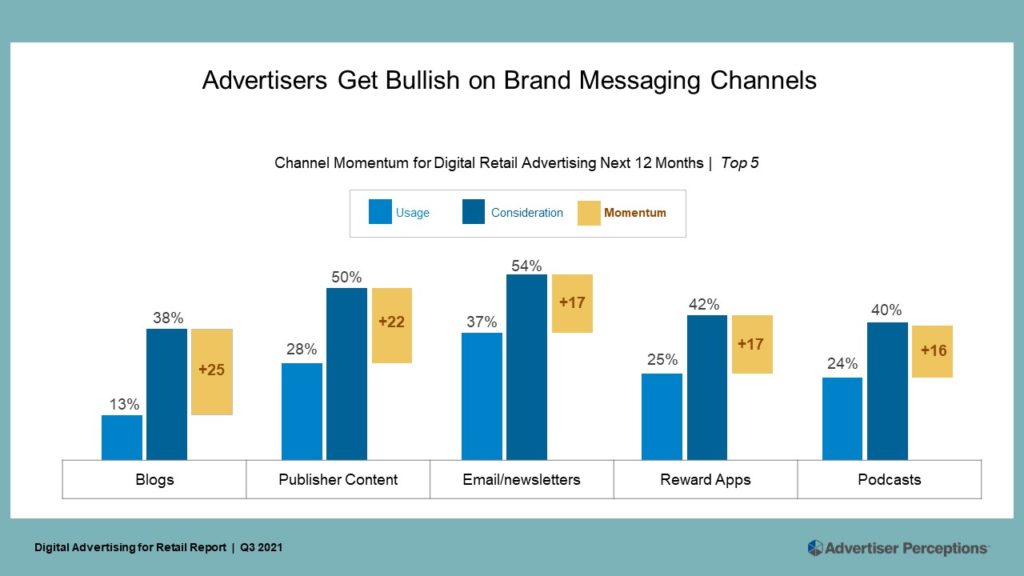

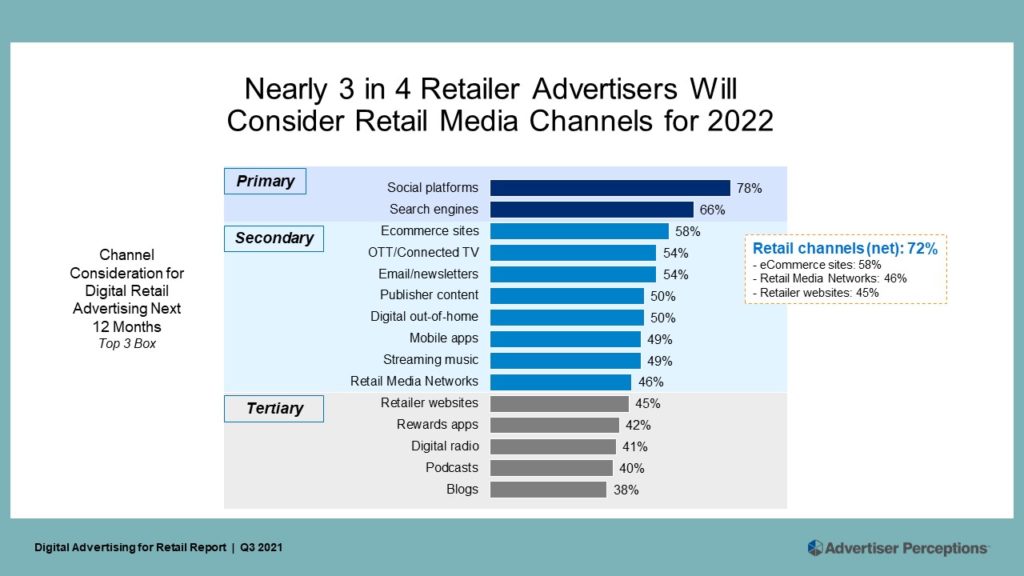

Old becomes new. Digital retail advertisers are kindling interest in “old” channels as they seek greater brand definition. Whereas retail advertisers have focused primarily on lower-funnel performance media, advertisers are increasing their reliance on advertising in such standbys as blogs, email newsletters and publisher content (e.g., native and branded content). For example, 28% are advertising against publisher content and 55% are considering it for 2022, while 13% are using blogs and 38% are planning to use them in 2022. At the same time, advertisers are also increasing their use of newer channels like podcasts and reward apps.

Retail media proliferation. This year, new entrants have swelled the ranks of ecommerce sites and retail media networks selling ads. While the triopoly (Amazon, Facebook and Google) come first on digital retail advertisers’ spending lists, almost half expect to advertise with retail media networks or retailer websites, while 58% focus on ecommerce sites.

“Now’s the time for retail media players to grow their voice in the marketplace,” said Nicole Perrin, VP/Business Intelligence at Advertiser Perceptions. “They’re getting more attention, but the field is crowding fast. To differentiate, retail media sellers need to bring their audiences to life for advertisers. They need to articulate the power of telling a brand story to targeted consumers, explain how their channel is different from others, and what advertisers can get from them that they can’t from a general-market commerce, search or social platform.”

Data concerns remain. Retailers’ shopper data fuels their ad platforms, and many advertisers are eager to capitalize on these assets. However, advertisers continue to cite data security as their number one challenge in digital retail advertising. This stands in contrast to other media arenas, where advertisers have ranked challenges with audience connection, scale and pricing as their primary challenges in most recent Advertiser Perceptions studies.

Advertiser Perceptions interviewed 201 retail advertising executives (53% marketer, 47% agency) from its proprietary Ad Pros Community in August 2021 for the latest Digital Advertising for Retail Report. It’s the third wave of the report, which refreshes every six months.