Advertisers change their tune on gaming and kids’ related programming and apps, and turn up their investments in audio, video and ecommerce platforms.

Mobile advertisers aren’t stuck in neutral as online identity solutions flux; their push to strike a balance between one-to-one targeting and the changing privacy landscape has many looking to more contextual placements, particularly across gaming and kid-themed content and apps.

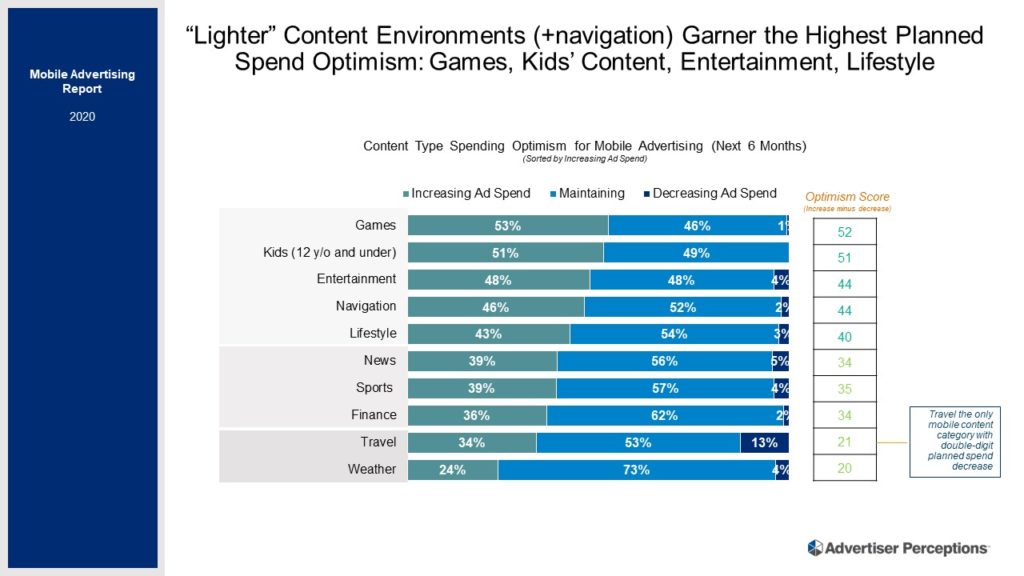

Context matters more than ever. Fully 70% of advertisers say context is more important now. They’re poised to spend more on content environments with overt context signals. Most notably, 53% of advertisers will spend more in gaming and 51% will spend more in kids’ programming. By contrast, only 36% of advertisers invested in games and only 15% sponsored kids’ programming in the past six months. Meanwhile lifestyle and entertainment content, which have been the principal content of mobile advertisers (lifestyle sponsored by 74% and entertainment by 61% of advertisers), will continue to get more advertising in the next six months as 43% of advertisers will increase spending on lifestyle while 48% up the ante on entertainment content.

“Of course personalized targeting is important, but what’s most important is where the consumers are and what they’re doing,” said Sarah Bolton, EVP/Business Intelligence at Advertiser Perceptions. “They have to be where the audience is going, and due to the COVID impact, areas like gaming, kids and entertainment content have seen massive audience growth over the past year.”

Approximate data is “good enough.” Fully 57% of advertisers believe approximate data will be a “good enough” substitute for GPS tracking. In fact, by the end of 2020, 37% of advertisers had already decreased or discontinued location-based data solutions because fewer consumers were out and about and privacy restrictions loomed. Confidence in the new world of mobile targeting differs by business type. Advertisers promoting online-centric revenue models are more likely to be confident without location-specific data than their brick-and-mortar-focused counterparts – 71% of mobile app businesses and 68% of those selling goods and services online are confident, whereas only 50% of omni-channel sellers and 27% of those representing offline-only businesses are confident.

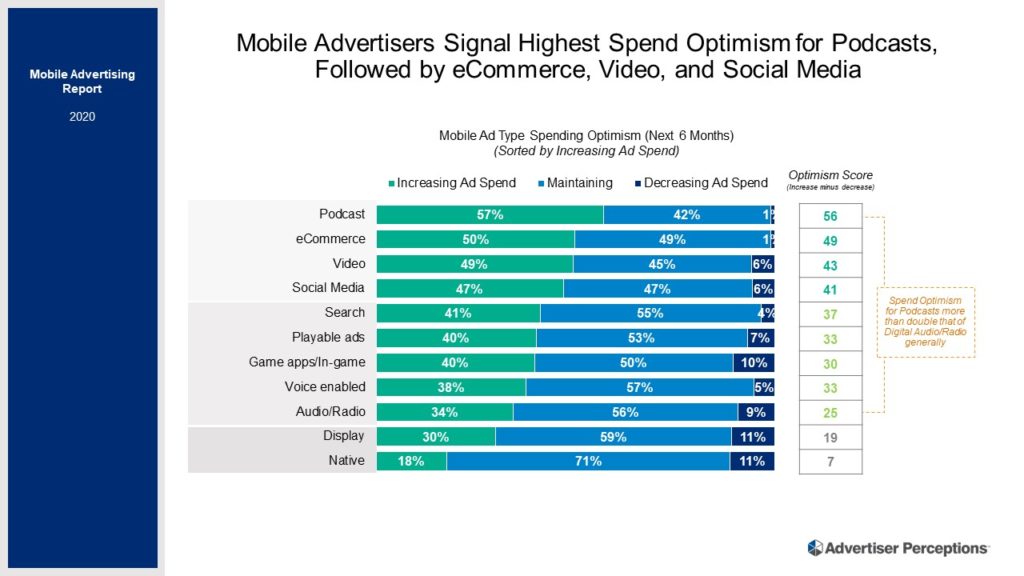

Paid social first. Paid Social is the clear juggernaut for mobile advertising, as 93% of mobile advertisers rely on the medium. That’s followed by display (84%), search (81%) and video (75%). Advertisers continue to eye social networks as a primary means of reaching their key audiences at scale—and advertisers see these platforms as arenas where they can still do one-to-one targeting at scale—at least for now. Nearly half (49%) says mobile audio is now “extremely important” for them, an increase of 12 points over Q4 2019, while podcasts earn advertisers’ highest spend optimism score.

“Walled gardens, especially the large social platforms, have the resources to adapt to privacy and regulatory changes,” said Lauren Fisher, EVP/Business Intelligence at Advertiser Perceptions. “But they need to reassure advertisers with better solutions for brand safety and protections against fraud, in addition to proving their privacy compliance.”

Mobile creative is best ever. Quality of creative is driving investment, as 61% of advertisers say it’s at an all-time high. “Social platforms are most responsible for why the quality of creative is at an all-time high,” said Bolton. They’ve driven much of the progress in ad format offerings and know what works, with programs like Stories ads from Snap and Instagram leading the way. Users lean forward and engage in these social experiences, which gives creative agency teams a great canvas for creativity.”

Advertiser Perceptions interviewed 252 advertisers – 40% marketer, 60% agency – in December from its proprietary Ad Pros community.