Video convergence is here. Video advertising convergence…not so much. Today’s consumer doesn’t differentiate between linear TV, digital video, and over-the-top options when viewing content. Yet, reaching consumers across the myriad video options remains a challenge for advertisers. Even the way advertisers think about various video advertising opportunities varies widely. To capture advertiser spending across all video opportunities, this study asks respondents about their “sight-sound-motion” advertising budgets.

MULTI-PLATFORM SOLUTIONS

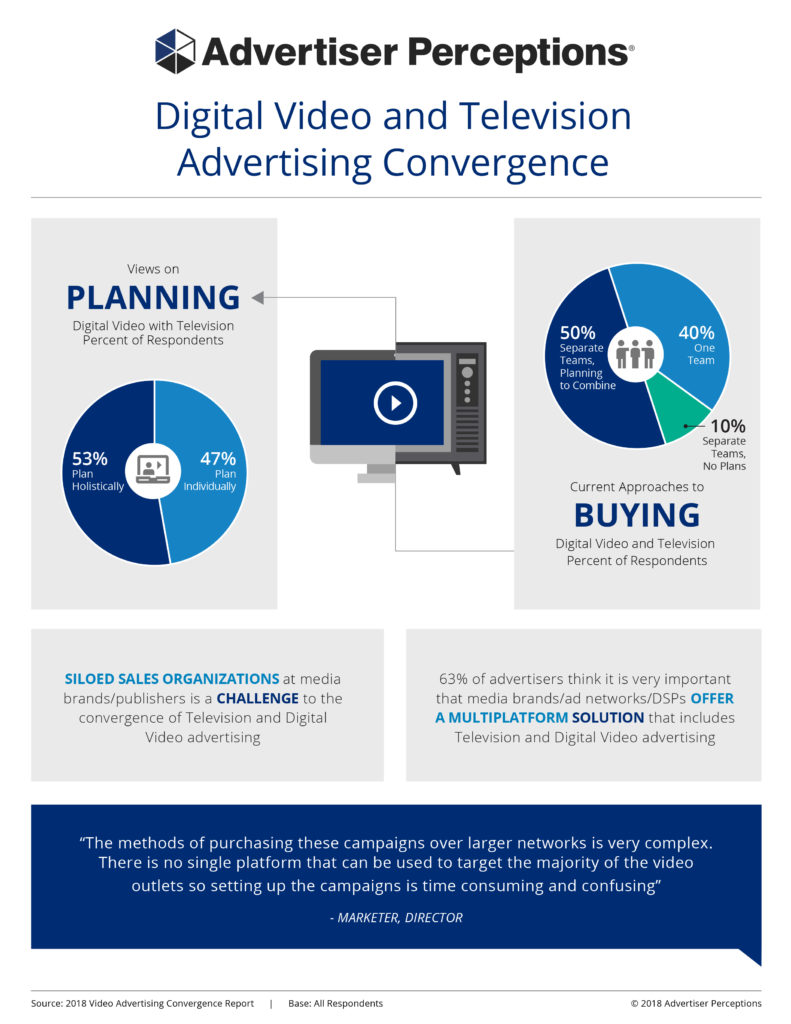

Advertisers continue to indicate greater budget allocation to digital video but are evenly split on their attitudes towards planning and buying digital video holistically with a TV campaign or as stand-alone strategy. Regardless of their current approach, two-thirds of advertisers agree on the importance of sellers offering a multiplatform solution – allowing for buying TV and digital video under one buy.

OPPORTUNITY FOR CONTENT SITES

Brand safety is top of mind for advertisers when it comes to digital video content. Platforms with the best quality video content – TV FEPs and Publisher Content sites – rose to the top position in this year’s study, overtaking Social Media sites, which have been hit with ongoing PR challenges around bots and fraud.

TARGETING DRIVES ADVANCED TV SPENDING

Advertisers report significant investments across the various Advanced TV opportunities as they seek out professionally produced, brand safe video content. At least one-third of advertisers report having already made significant investments in over-the-top TV, set-top box VOD, addressable, data-enabled linear, and programmatic TV. These investments are heavily driven by the desire for greater audience targeting on TV.

WAITING ON INNOVATION IN AD UNITS

Regardless of where advertisers are spending their video budgets, they remain focused on tried and true ad formats. Newsfeed ads, pre-roll, and unskippable ads are reported as the most important ad formats, despite the talk in trades of the “death of the interruptive ad model.” This is not a one-sided issue, buyers need to create demand for new ways to reach consumers and media companies need to develop those innovative models. We look for this to be a large focus in the coming year.

LOOKING AHEAD

- Look for the language around TV and video to get more complicated before it gets more standardized, as purveyors of professionally produced video define their offerings beyond the generic “digital” and “OTT” – genres that many advertisers rule out broadly and blindly.

- Structural issues (planning, measurement, reconciliation) will continue to retard omni-channel buying by advertisers. Media companies should help solve those challenges for their partners. This will require a disciplined, industry-wide approach.

- Brand Safety discussions will lead to more meaningful interactions between advertisers and publishers around context and value of various video content types to better define premium video.

- As the commoditization of cable television continues, look for a greater embracing of programmatic linear TV. Local advertisers, who are growing accustomed to the capability will look for it when buying national TV; Broadcasters will see it as an opportunity to drive CPMs.

Download the report Executive Summary HERE…