The second half of 2020 marks a new beginning for advertisers and media, according to Wave 5 of The Coronavirus Effect on Advertising – a six-part, biweekly report from Advertiser Perceptions. Advertisers expect to launch more new products this summer and fall, and they are treating Q3 as a restart, rather than a rebound, approaching the market with new, continuously adaptive strategies and expectations. In the process, they expect to entertain new messaging, tactics, and partners.

“The second half of 2020 will be a more dynamic advertising market than we’ve seen in many years,” said Justin Fromm, EVP/Business Intelligence at Advertiser Perceptions. “Advertisers are restarting in a crowded space with lots of moving parts – product launches, an election, and competitors trying to make up for lost time. They’re prepared to explore alternatives to tent-pole media they had originally planned, and they need help balancing the nuances of timing and pricing that regional differences present.”

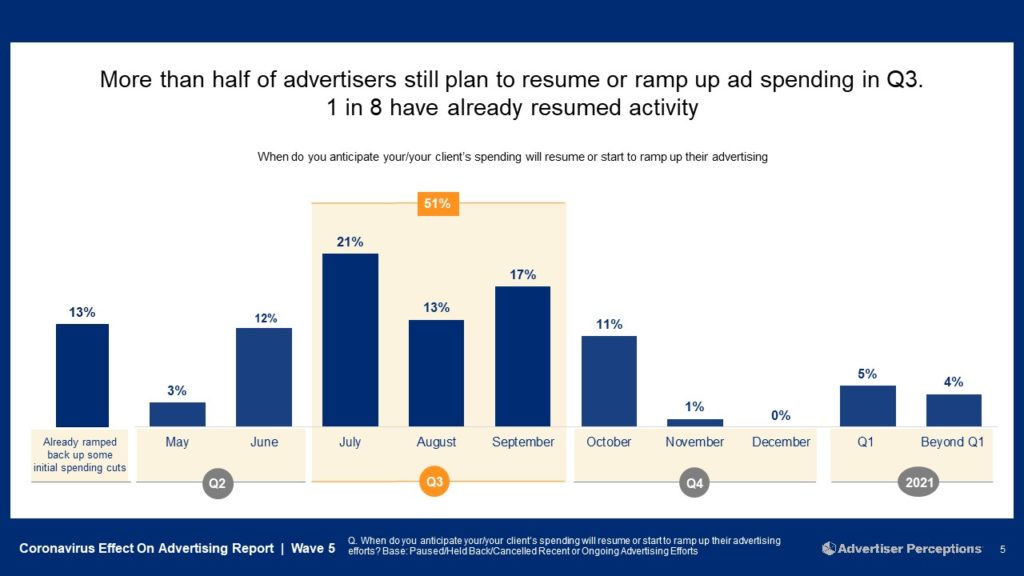

According to the Wave 5 research, nine in 10 advertisers plan to launch products/services in the second half – 48% postponed launches, and 41% previously scheduled efforts. To support this, more than half of advertisers still plan to ramp up ad spending in Q3, while 28% are accelerating spending before the end of June.

Other key Wave 5 findings:

Strategy is in flux. More than half of advertisers have scrapped their initial 2020 strategies and started on new plans. While 29% have a strategy in place for the “new normal,” 52% say they are still working on one. And the focus of strategy varies widely, with some advertisers resetting KPIs altogether. While 58% say it’s time to replace COVID-19 messaging with product-specific ads, 43% are hampered by difficulty producing new creative, and half aren’t sure what their message should be.

Media is being re-examined. Even with live events resuming, there’s a new willingness to explore alternatives. More than half of advertisers had planned to advertise in postponed live programming, and 75% of them are open to “acceptable substitutes” – particularly video in entertainment, lifestyle and gaming content. Advertisers are redefining “brand safe,” with many avoiding media that feature user comments.

Regional pre-empts national. Stark regional differences in reopening the economy are making it difficult for 68% of advertisers to plan national campaigns. “This presents a great opportunity for media with broad reach and targeted, digital platforms,” said Fromm. “TV and cable have lots of regional, audience-based messaging opportunity, and social has become an important reach and performance medium. Now’s the time to bring them together in a thoughtful way, to help advertisers ensure regional relevance.”

Flexibility is the new standard. Throughout the Advertiser Perceptions Coronavirus research, advertisers have stressed the importance of media helping them pause and shift spending as needed. Once again in Wave 5, 64% of advertisers said this flexibility is what they now expect from media and ad tech partners.

The performance bar is rising. While two in five advertisers relaxed their own media ROI goals and more than a third lowered media ROAS (return on ad spend) goals over the past three months, many say they are raising expectations. As one restaurant-focused agency chief executive put it, “we need to generate fast results to make up for all the down time.”

More than ever, though, advertisers will need to balance channel-specific objectives against company-specific KPIs. Many responded initially to the pandemic by moving money from brand to performance channels.

“Advertisers need to keep their eyes on longer-term goals like revenue and lifetime consumer value, not just plunge into performance media,” said Lauren Fisher, VP/Business Intelligence at Advertiser Perceptions. “That’s a recipe for fraud and consumer burnout, both of which damage brand relationships.

“The advertisers that come out of this in the best shape will get the most out of media while hitting their larger company goals,” said Fisher. “Media play a key role here. Sellers need to help advertisers continually refine their audience targets and reset their performance metrics.”

Advertiser Perceptions surveyed 151 advertisers from May 18-21 for Wave 5 of its Coronavirus report. Respondents were 34% marketer, 66% agency executives, all part of the company’s Ad Pros proprietary community.