Advertisers pay rising premiums to lock in premium content, prioritize CTV, and plan to attend future in-person events.

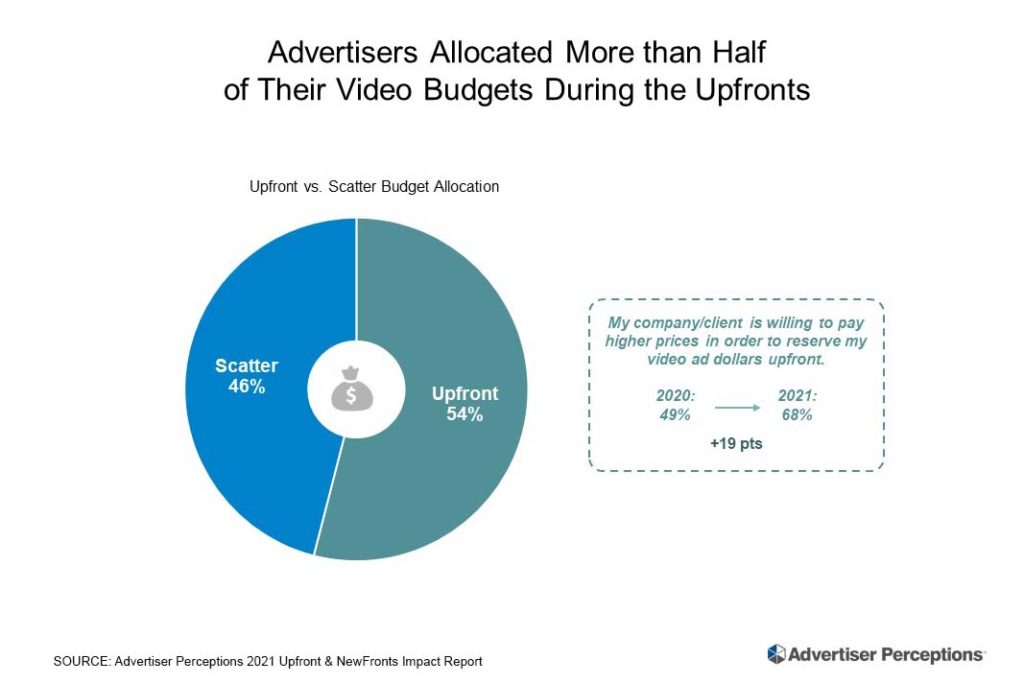

Advertisers spent more than half of their video budgets at the 2021 Upfronts and paid higher prices to do it, according to the Advertiser Perceptions 2021 Upfront/NewFronts Impact Report.

On average, advertisers allocated 54% of their total video budgets (TV and digital) to this year’s Upfront, and CTV got 37% of the Upfront spend. What’s more, 37% of advertisers made CTV their primary buy.

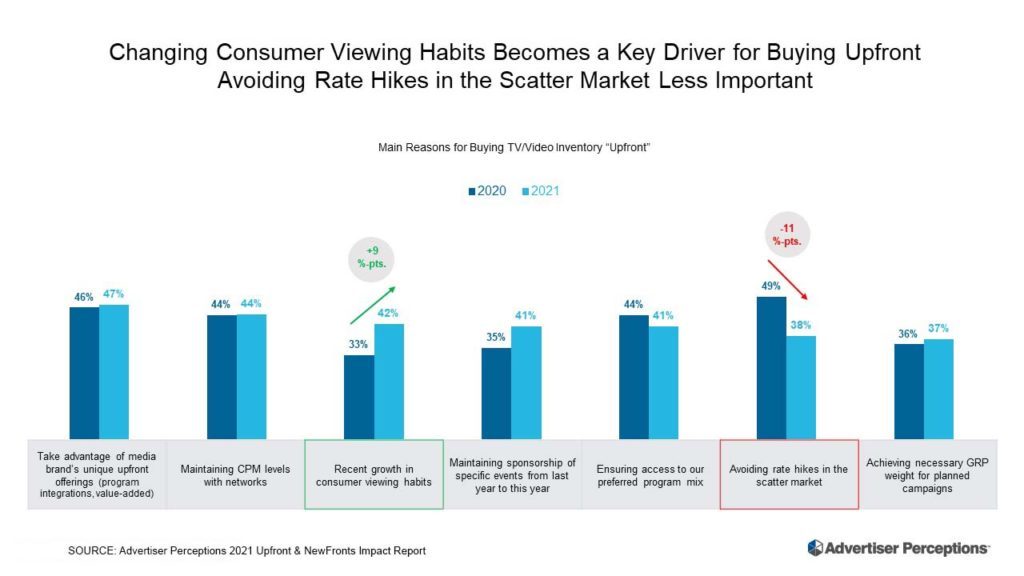

“Let’s add another acronym into our advertising lexicon, Upfront FOMO,” said Erin Firneno, VP/Business Intelligence at Advertiser Perceptions. “Upfront spending rose and outpaced pre-pandemic levels as advertisers were willing to pay higher prices to ensure they would not get closed out of their preferred content. And that preferred content was streaming.”

Premium price tags. Nearly 7 in 10 (68%) advertisers say they are willing to pay higher prices to lock in video ad opportunities; that’s up 19 points from last year.

Portfolios, not programs. Better than two-thirds (65%) of advertisers are prioritizing providers that offer video across more channels. In picking media partners for TV and video, only 12% put the quality of individual programs first, while 40% go with the most conglomerated. And 85% say they are more likely to buy advertising in more properties when they attend a multi-brand Upfront event. “As audiences redefine prime time and programming, the companies that showcase a wider portfolio at the Upfronts have a decided edge,” said Firneno.

In-person preferred. Fully 84% of advertisers plan to attend the 2022 Upfronts/NewFronts in person. What’s more, 41% of advertisers said they would attend multiple, themed events throughout the year (vs. 34% last year).

Advertiser Perceptions interviewed 307 advertisers – 50% marketer, 50% agency – who run national TV and digital video advertising in June 2021 for this report.