New Report from Advertiser Perceptions Shows Advertisers’ Robust Video Plans for 2022.

Advertisers can’t get enough video, so they’re upping their ad budgets to make room for more connected, digital and linear TV, including brand integrations. That’s the gist of the latest Video Advertising Convergence Report from Advertiser Perceptions, which has tracked the phenomenon in the US biannually for the past five years. The new report details the complex relationship advertisers are developing with video.

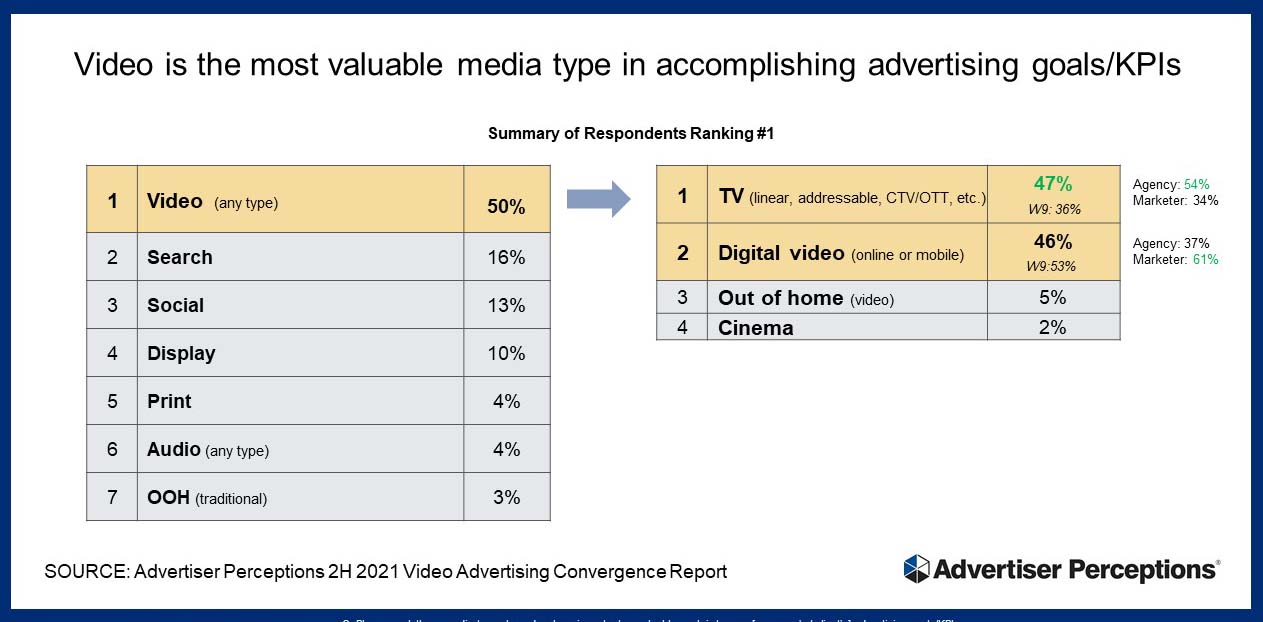

TV most valuable. Video eclipses all other media in achieving advertising goals, and TV leads within video again. Specifically, 47% now rank TV in all its forms first – up from 36% a year ago. By contrast, 46% put digital video first, down from 53% a year ago.

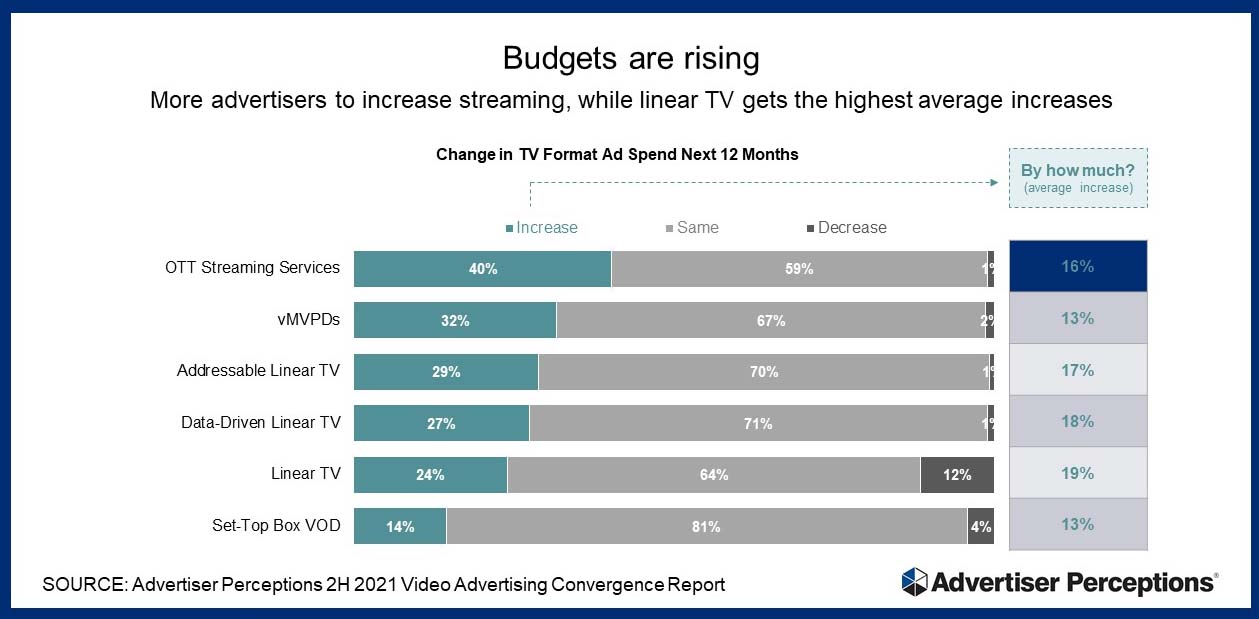

Half of US advertisers will put more money into video advertising this year, on average increasing by 25%, with 75% of them increasing their overall budgets to accommodate the increase. While more advertisers will increase ads on CTV/OTT, they will spend more money in linear TV. Two in five advertisers will increase their CTV/OTT ad spending by 16% on average. Meanwhile, one in four will add more linear TV ads, increasing spending by an average of 19%.

“The rising video tide is lifting all boats, just not equally,” said John Bishop, VP/Business Intelligence at Advertiser Perceptions. “Streaming is attracting priority attention as the medium adds content and audiences, while linear TV continues to get the highest dollar volume. As streaming grows in forms and value, we can expect to see more innovation and advertiser investment.”

Digital video sells. Short-term professional video tops advertiser rankings for meeting advertising KPIs, with 61% putting it in the top three of all formats, followed by full episodes (54%). That’s ahead of social media influencers videos (49%), user-generated video (39%) and advertising in sporting events (36%, down from 44% a year ago).

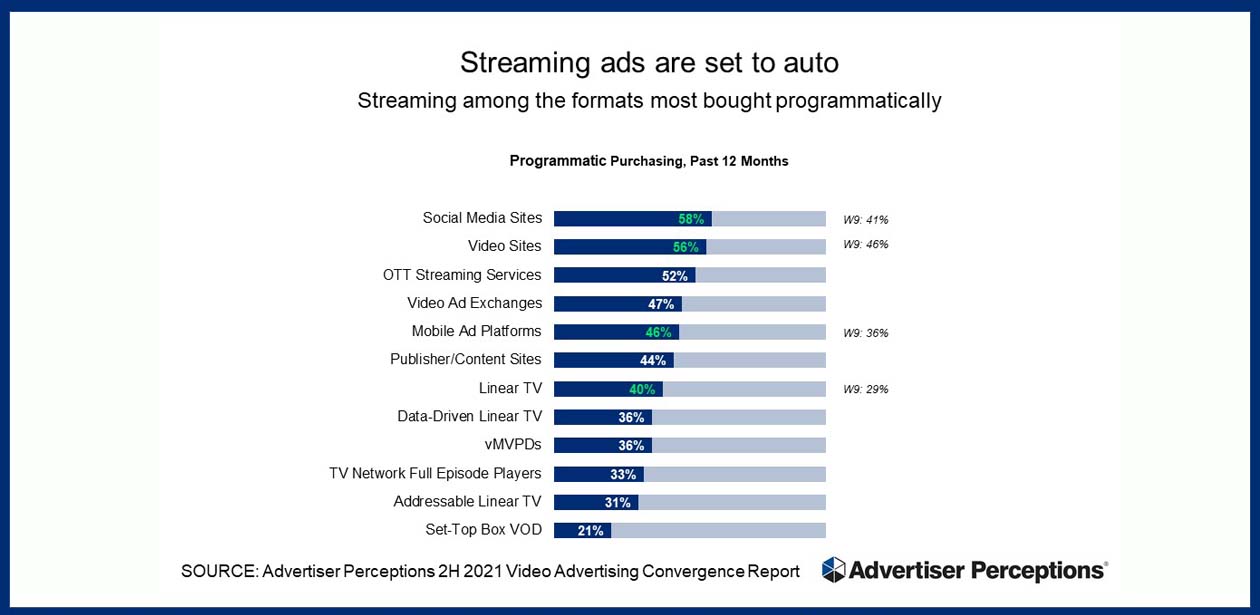

Automated buys abound. The explosion of streaming has led more than half of advertisers to buy video ads programmatically in the past year, and they expect to increase their activity this year. The second half of 2021 showed big jumps over the first half in programmatic buying of video ads on social media, video sites, mobile ad platforms and linear TV.

Ad-free doesn’t mean brand-free. One in three advertisers see ad-free streaming as a net positive – it creates more audiences – while half say brand integrations will be the only way to reach a large portion of long-form content viewers two years from now.

Are we buying blind? As they add more digital video and CTV/OTT advertising to their mixes, 60% of advertisers fear they are losing sight of the reach, frequency and effectiveness of their entire campaigns.

“In the past year, the video industry has moved to address long-standing measurement challenges to keep advertisers confident in campaign results,” said Bishop. “Advertisers need media to keep improving transparency around ad placement and engagement. The more they do, the more advertisers will invest in video.”

Advertiser Perceptions interviewed 250 U.S. advertisers (63% agency, 37% marketer) in October 2021 for the latest Video Advertising Convergence Report.