Advertiser Perceptions frames the opportunity for buyers and sellers

Despite perceptions that cord-cutters will make the TV future ad-free, connected TV (CTV) is expanding the frontier for advertising. There are unrealized growth opportunities for advertisers and publishers, according to insight from Advertiser Perceptions and Hub Research, which have combined perspective and research to frame the state of CTV advertising.

What’s happening: Viewing isn’t either-or. Although more people are cutting the cord, most viewers view a combination of linear and streaming TV. People are using more TV platforms than ever (six on average) while a growing percentage use CTV (smart TVs) to control their portfolios of viewing options. They’re doing it principally to get exclusive content and deep catalogs at a reasonable price, not to avoid ads.

What’s ahead: Ad-supported CTV viewership will keep rising, and CTV budgets are set to climb again in 2023. According to new Advertiser Perceptions analysis, a majority of advertisers (54%) plan to increase their CTV advertising in the next 12 months

What’s needed: Advertisers need to test and learn across more of the available platforms – particularly as CTV incorporates more ad formats, from display to interactive ads – and make greater use of personalized advertising. They also need to break-out of their buying silos. Currently, only one in three advertisers buy across all three main inventory sources (CTV devices, AVODs and vMVPDs). Meanwhile, publishers need to differentiate their offerings more thoroughly.

“Advertisers should get out of their comfort zone and explore all the innovative ways to advertise on CTV,” said Erin Firneno, VP/Business Intelligence at Advertiser Perceptions. “Publishers can grow the category by promoting their unique offerings, whether that’s scale, unique audience, exclusive content or shoppable ads.”

Data Basis – Advertising: CTV has the promise of bringing digital performance to TV screens, and updated buying practices can unlock growth.

CTV still plays a supporting role.

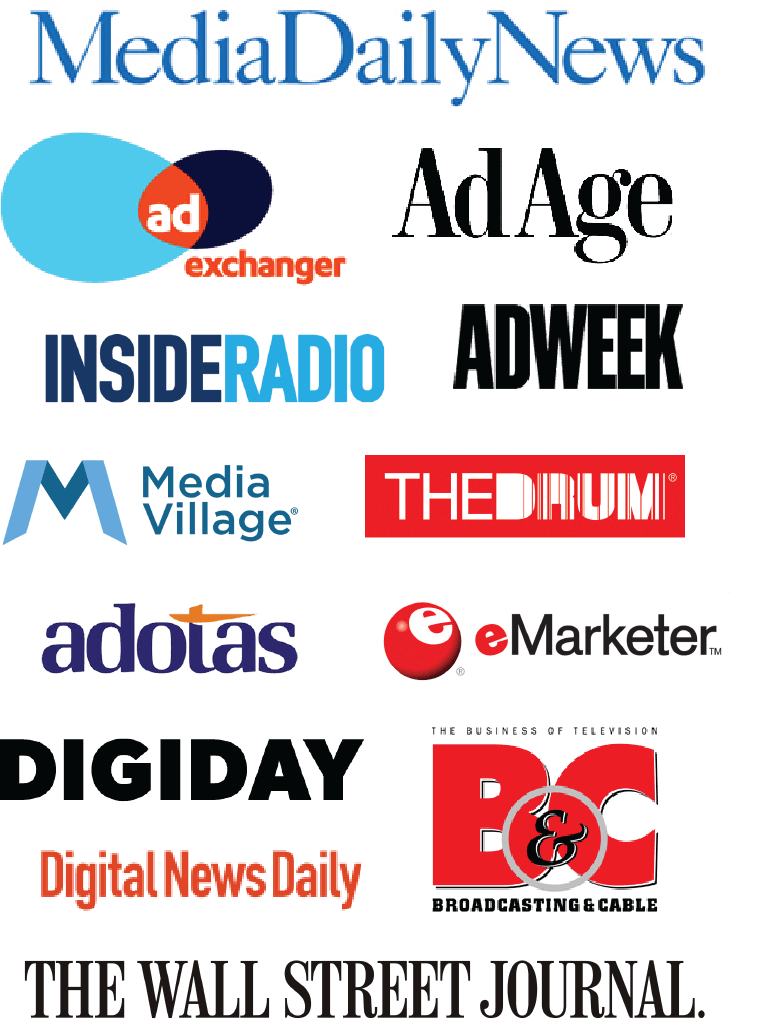

- Slightly more than half (51%) of advertisers plan linear TV first – 16% include CTV inventory as make-goods, while 35% say linear TV is their primary buy with CTV in support. Another third plan both together now, while 15% plan CTV-first.

Advertisers are siloed.

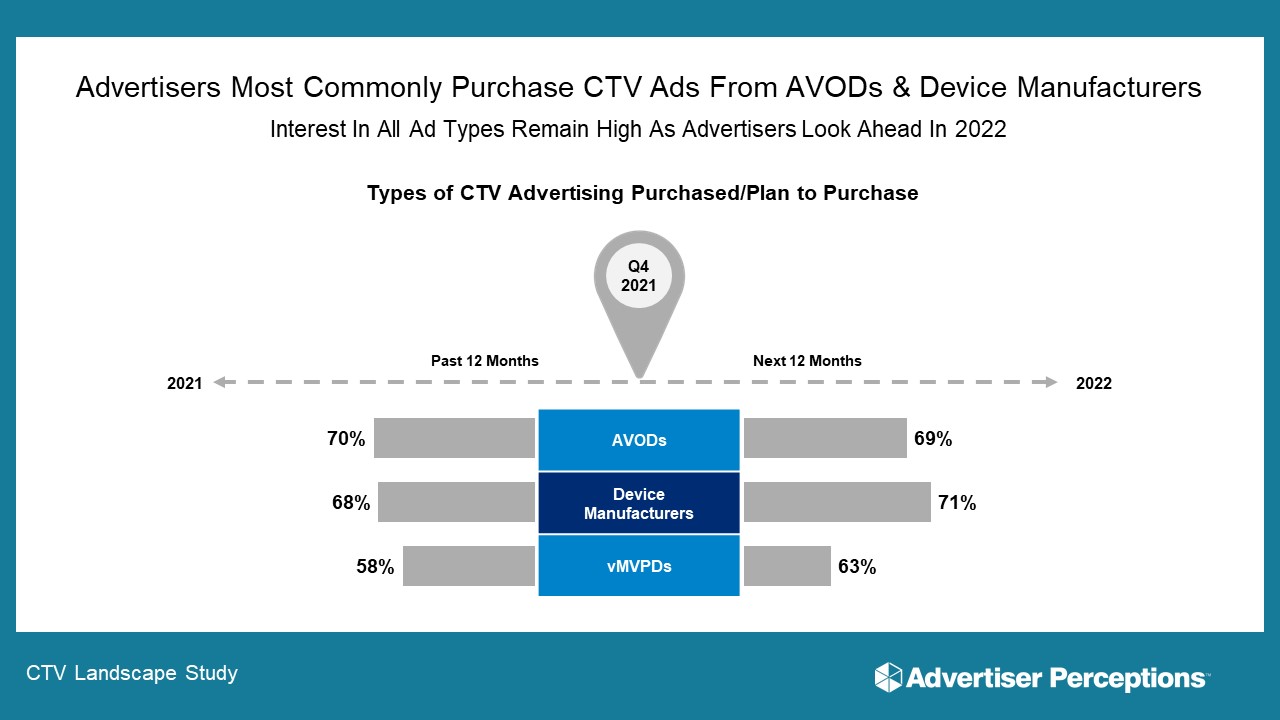

- Although most plan to buy all three CTV inventory types in the next 12 months – 71% from CTV devices, 69% from AVODs, 63% from vMVPDs – only 32% are buying across all three inventory types.

SUPPORTING DATA – Based on Hub Research Findings

“The best days of ad-supported TV are ahead of us, not behind us,” said Jon Giegengack, Principal at Hub Research. “Significantly more people watch ad-supported than ad-free platforms, and the combination of exclusive content, lower cost and a less disruptive ad experience will keep ad-supported audiences high.”

Data Basis – Viewing: CTV growth isn’t about avoiding ads; most CTV viewers are willing to watch ads if it will save them money, get them access to exclusive content, or both.

- Among those who consider themselves tolerant of ads, about three-quarters (72%) say they’d watch ad-supported TV if it saved them $4-$5 a month.

- And even among those rank themselves the most ad-intolerant, one-third (30%) would choose an ad-supported platform over an ad-free one to save that amount.

What’s more, targeted ads are associated with greater enjoyment of the shows they appear in.

- Among those who had recently watched a show on an ad-supported platform, 44% were highly satisfied.

- But satisfaction was significantly higher among those who said they saw “ads based on my search history” (56%) or “ads that were customized for me” (60%).