Think streaming networks will displace TV giants? Think again.

New research from Advertiser Perceptions shows that advertisers are upping their ante on video, and the pandemic has pushed streaming to one-quarter of TV screen advertising budgets.

Yet the largest spenders are favoring the Connected TV (CTV) options of established networks over streaming startups. This has a direct bearing on the 2021 Upfront, as most advertisers expect to keep their allocations consistent (40% Upfront/60% scatter) and their ears tuned to how networks will improve cross-screen opportunity, measurement and brand safety.

Half of video advertisers (52%) will increase their video spend over the next 12 months, with the remainder keeping their video spend at the same level; Most of those who are increasing (77%) indicate that video ad spend is increasing at a faster rate than other media. Among all advertisers, video leads all other media as most important: 49% rank video first, with search a distant second (19%), social in third at 13%, and display in fourth at 12%.

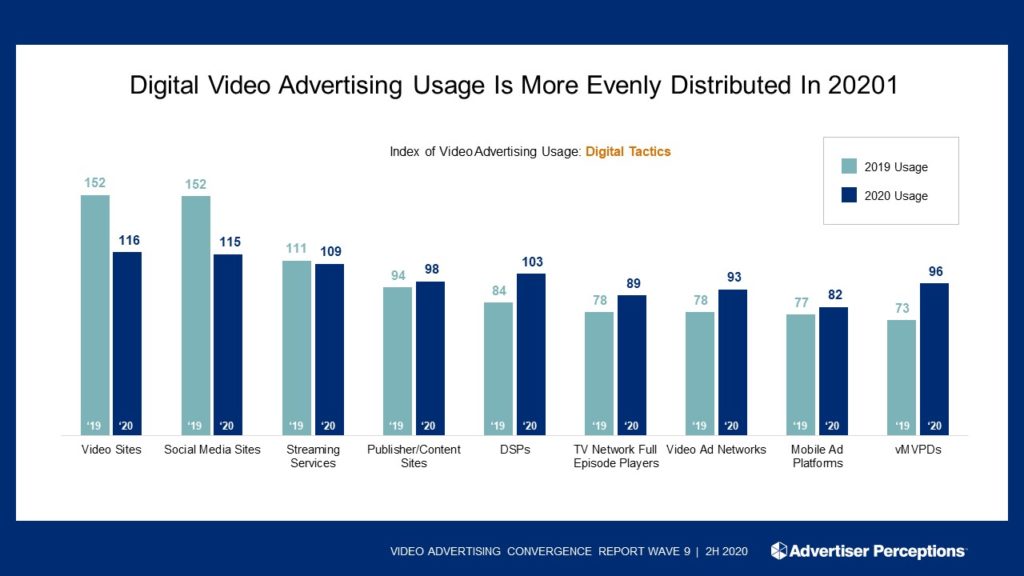

Reach rules. Reach is the most important factor when advertisers evaluate CTV partners, and ranks a close second to targeting capabilities (53%) for programmatic CTV. While 45% of advertisers believe that they can achieve their reach goals without linear TV, overall advertisers are decreasing reliance on video sites and social media and increasing their use of programmatic TV options (e.g., DSPs, vMVPDs).

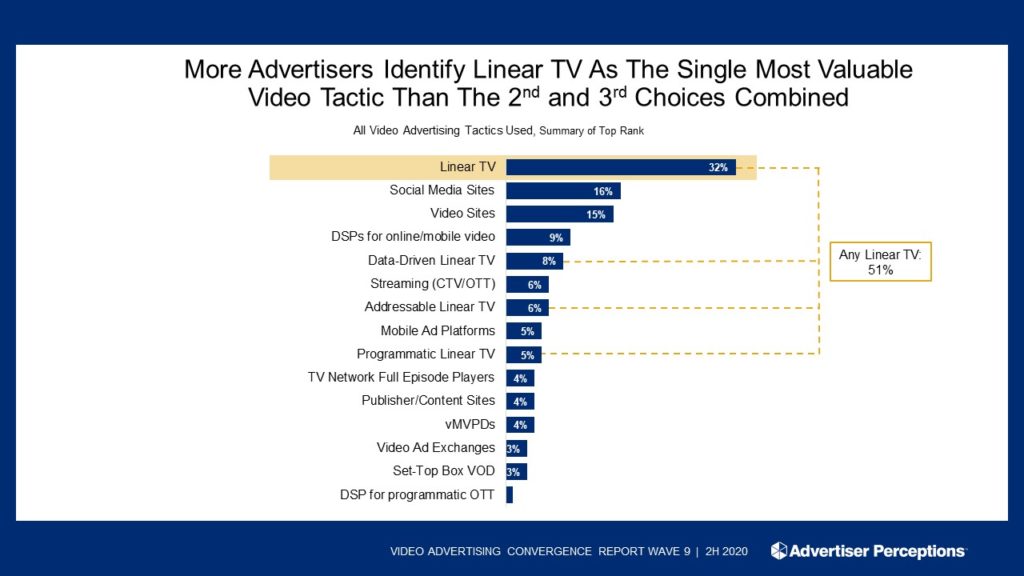

Prioritizing TV. Overall, more video advertisers find linear TV to be the most valuable video platform than the leading contenders combined. More than half (51%) pick linear TV options as their top priority, versus 31% for social media (16%) and video sites (15%).

Size divide. Those spending less than $25 million indicate that video and social media sites are more effective than linear TV. Those spending $25 million or more still prefer linear TV and rely less on video sites and social media.

Murky measurement. The problem most cited by advertisers as they spread their video budgets out across platforms to reach a fragmented audience is measurement. Fully 58% say that the more impressions they buy outside of linear TV, the harder it is for them to know the precise reach, frequency and effectiveness of their overall video advertising campaigns. This will play big at the 2021 Upfront, as 75% of advertisers are primed to hear how media companies will balance expanding reach with innovation in personalization and cross-screen measurement.

Fleeing fraud. Advertiser concern is mounting over fraud in online video, but most are fleeing rather than confronting it. Nearly four in five advertisers identify OTT fraud as a concern, particularly as programmatic OTT grows. Larger advertisers especially are fleeing to the relative safety of TV networks’ CTV options. And advertisers overall increasingly hold digital video platforms to linear TV-type assurances, insisting that their ads appear on reputable sites (87%), pair with brand-safe content (80%) and run within professionally produced video content (79%).

“Big TV networks have really beefed up their CTV opportunities at the right time,” said Justin Fromm, EVP/Business Intelligence at Advertiser Perceptions. “They’re becoming safe harbors for the largest advertisers as fraud climbs in the medium. While the major Internet platforms will lead in volume of streaming ads, TV network safety is keeping them the gold standard in video as the platforms evolve.”

Advertiser Perceptions interview 284 advertisers (42% marketer, 58% agency) in November and December 2020 for its Video Advertising Convergence Report. Another 300 advertisers were interviewed in January 2021 about the Upfront.