Advertiser Perceptions finds publishers turning more to SSPs for new identify strategies as they move beyond cookieless solutions.

Publishers aren’t as savvy as they need to be about how to use their own first-party data, and they are increasingly looking to SSPs for guidance on new identity strategies. They realize that sharing their first-party data easily and securely will be a big advantage in the post-cookie world, as advertisers experiment with many emerging solutions to create suites of options. The SSPs that design flexible identity solutions to fit many scenarios will attract the most publishers and advertisers. That’s the upshot of a new SSP Report from Advertiser Perceptions

“SSPs may come out the surprise winner in the post-cookie market, as they work to deliver for both the buy side and sell side at the same time,” said John Bishop, VP/Business Intelligence at Advertiser Perceptions. “The post-cookie targeting and measurement market is open to a variety of players, so brands and agencies will dictate which solutions gain traction. Publishers will need to show flexibility and value in the form of data sharing to be attractive throughout this period of experimentation.”

SSPs matter to publishers, especially Google. Google Ad Manager ranks as the #1 most popular SSP for publishers in the past 12 months, with Amazon Publisher Services (APS) and PubMatic rounding out #2 and #3. Google and APS are particularly attractive to publishers as they provide access to an enormous range of advertiser demand in unique environments

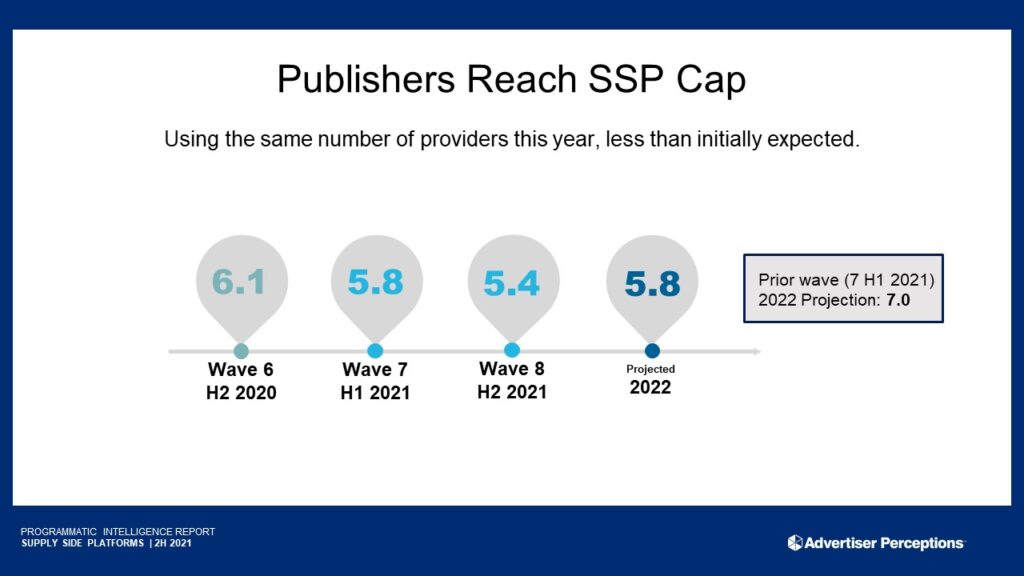

As brands look to reduce the number of partners they work with through the supply path optimization (SPO) process, Google and APS have benefited and attracted publishers as a result. The majority of independent SSPs are fighting it out for the remaining publisher demand as publishers held steady at an average of 5.4 SSP partners in 2H 2021.

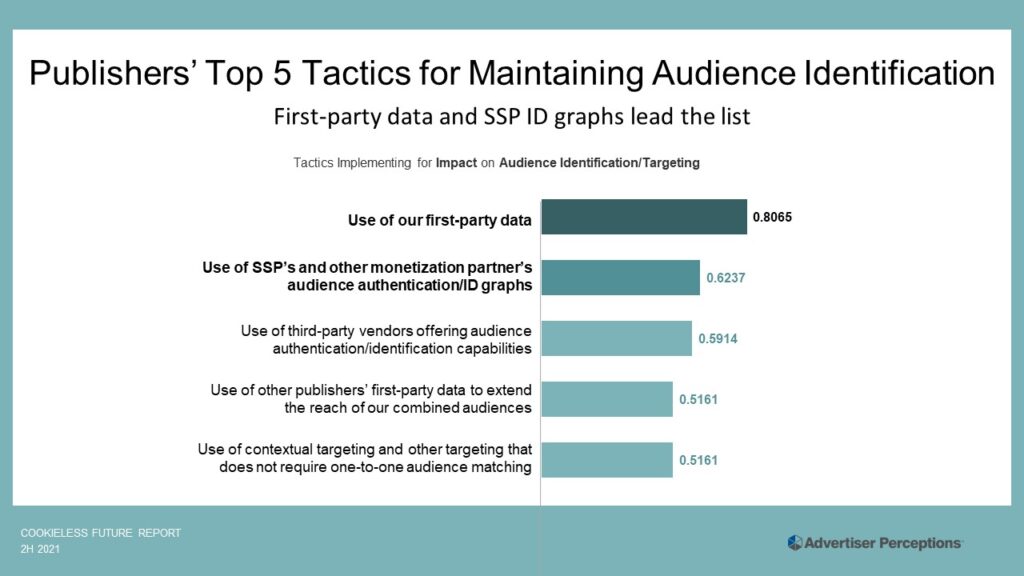

“Publishers are looking to their own first-party data and to SSP partners as audience identification and targeting evolves away from third-party cookies,” said Bishop. “Without a leading third-party cookie alternative, publishers will need to be able to work with a broad variety of approaches and bring their own unique value to the table at the same time.

Varying first-party data maturity. While 81% of publishers plan to use their own first-party data to maintain audience identification for their advertisers and to provide targeting capabilities, not all have mature strategies. Only a quarter of publishers consider their first-party data strategy very mature, while just under half (48%) are somewhat mature. Many publishers are ramping up efforts to collect more first-party data through subscriptions, newsletters, apps and a rising trend to have commerce capabilities.

Waffling on first-party data sharing. Not all publishers are on the same page. More than half, 51% are somewhat or very unwilling to share first-party data with partners, which makes it difficult for publishers to extract maximum value from this asset. Demand from brands may encourage more publishers to find secure data-sharing solutions, such as data clean rooms, that can help enable targeting and measurement while keeping first-party data safe.

“Publishers have come to understand the need to respect their users’ privacy and protect their data,” said Nicole Perrin, VP/Business Intelligence. “They’ve also learned that their own first-party data is valuable in large part because it’s proprietary and unique. Secure data collaboration tools like data clean rooms can help publishers get the most out of that data without compromising those values.”

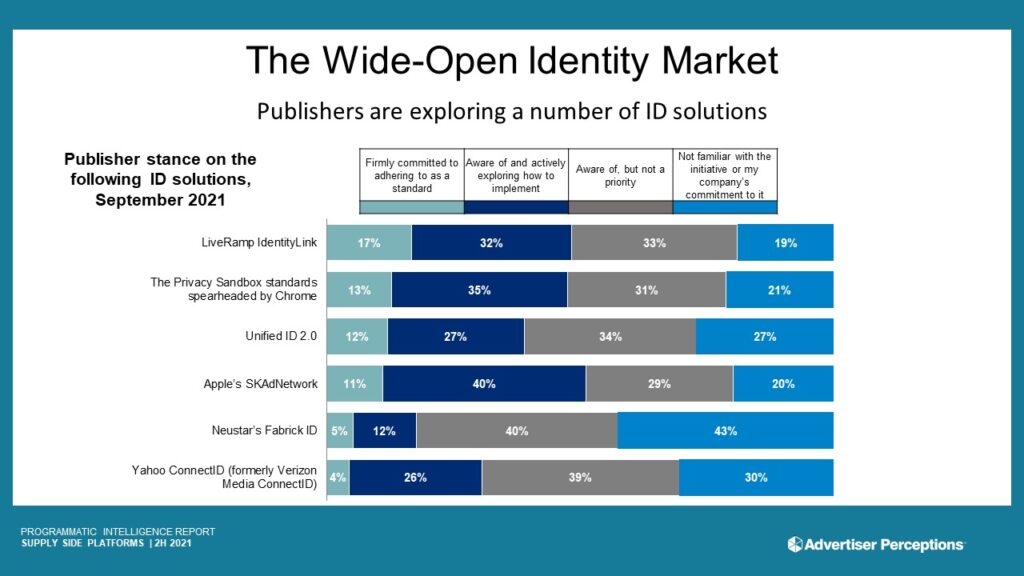

Lots of choices, no clear winners. No single identity solution has emerged as the winner with publishers. The solution with the highest number of firmly committed publishers – LiveRamp IdentityLink – only had 17% of the market firmly committed to adhering to it as a standard as of September, 2021. Apple’s SKAdNetwork, focused on mobile identity, has higher awareness, but only captured 11% of publishers.

Fragmentation without a leader. Google’s lack of a cookie alternative has set the market into a potential fragmentation without a clear leader in identity for the foreseeable future. For buyers and sellers, this means no one clear path forward: Testing out and educating themselves on multiple solutions will continue to prove essential. As for those in possession of identity solutions, it means a wide open market of opportunity.

“Publishers are unlikely to find a ‘silver bullet’ solution to replace third-party cookies, which will give rise to a range of solutions in-market at the same time,” said Bishop. “We expect that publishers will continue to lean into their own data and their SSP relationships to navigate the complexity and help determine which solutions to bet on for the future.”

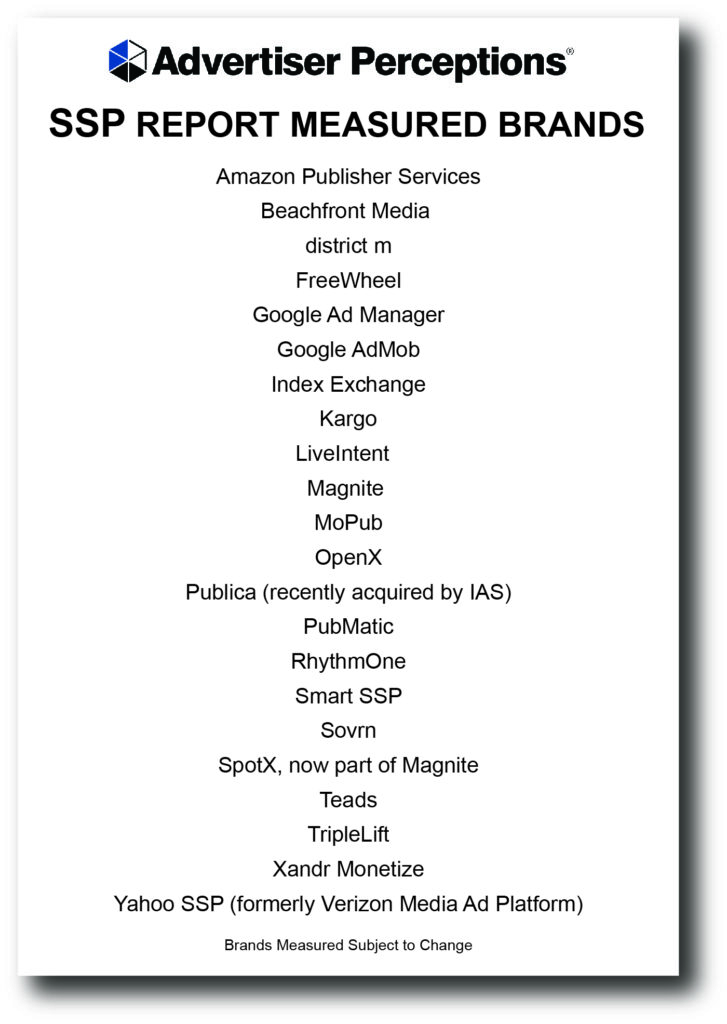

Advertiser Perceptions interviewed 152 U.S. publishers between August 25 and September 8, 2021, for the latest Supply-Side Platform Study (H2 2021).

CONTACT US TO LEARN MORE ABOUT OUR SSP MARKET REPORT

The Supply-Side Platform (SSP) Report explores the major changes affecting publishers and their use of SSPs to monetize ad inventory today, including the media and channels advertisers turn to SSPs to monetize and the technology, performance and relationship criteria of import when selecting an SSP partner.